Wikimedia/Flickr

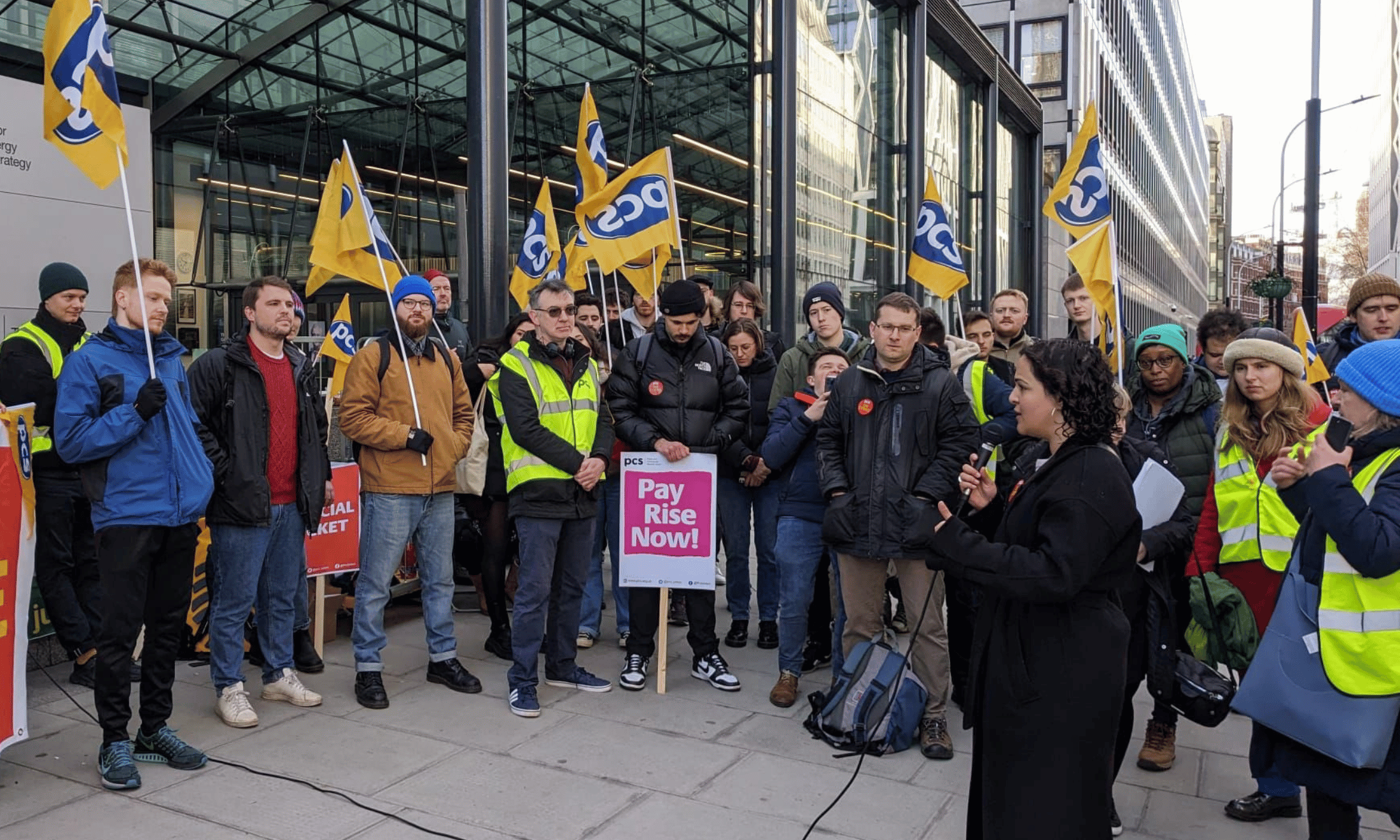

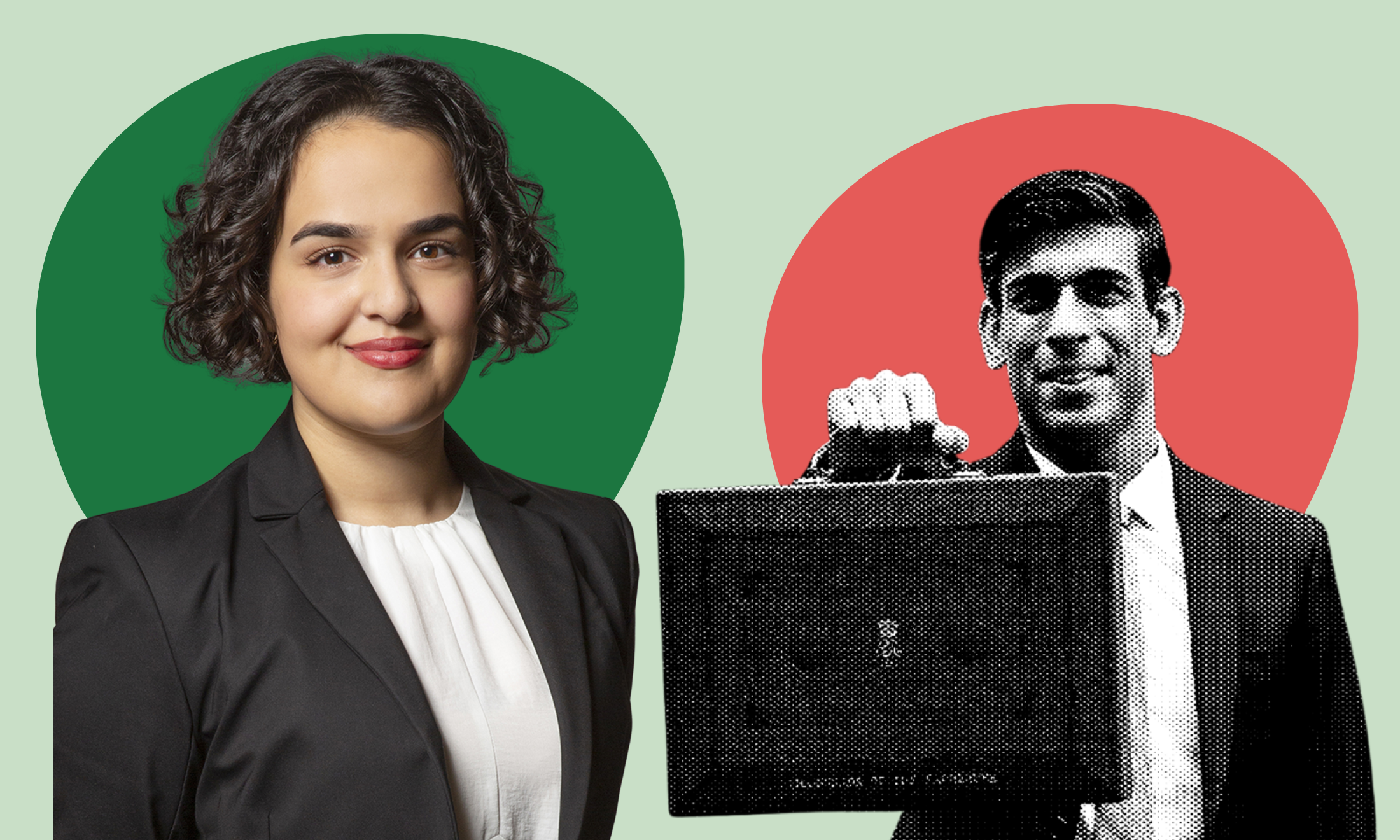

Nadia Whittome: ‘Rishi Sunak’s Autumn Budget ignores the climate crisis in favour of champagne for the rich’

The chancellor's autumn Budget is an empty glass for the majority of the UK public, says the Labour MP.

Nadia Whittome

29 Oct 2021

For those of you who didn’t find the time to take an hour of your Wednesday to watch the Budget speech in full, you will have missed Rishi Sunak having a whale of time – cracking jokes about reducing the price of champagne and promising a “new age of optimism”.

But while the glass might look half full to the Chancellor – a millionaire himself – for the families of the five million children living in poverty, or those struggling with soaring heating bills and the cost of their weekly shop, it’s completely empty. This Budget will not help many of them.

Perhaps the biggest headline was the 60p rise in the minimum wage for those over the age of 23. While this increase is welcome, tax hikes, Universal Credit cuts and rising energy bills will mean that it has little impact on people’s disposable income. The pay rise for 16-20-year-olds is also far less generous.

While Sunak ended his upbeat speech with an impassioned case for lower taxes, in reality the government is raising taxes for working people to their highest level in 70 years. As announced last month, National Insurance contributions are rising by 1.25 percentage points. For the vast majority, that means it is going up from 12% of your income to 13.25% – a 10% tax hike.

The Resolution Foundation warned that measures introduced since Boris Johnson became Prime Minister, including those in this week’s Budget, will cost households £3,000 a year more in tax.

To slightly soften the devastating blow of the Universal Credit cut earlier this month, the Chancellor promised to lower the UC taper rate – the amount your Universal Credit decreases as your earnings increase.

But this will only partially offset the impact of losing £20 a week for many of those in work and will do nothing for people who are not working, such as disabled people, those with long-term illnesses, carers, and single parents with young children. These families also face rising energy and food prices, but are being punished for their inability to work.

“While Sunak ended his speech with an impassioned case for lower taxes, in reality the government is raising taxes for working people to their highest level in 70 years”

Around 75% of the 4.4 million households on Universal Credit will still be worse off. Children will go hungry, homes will be cold and damp, and parents will fall further into debt. It is those who already have the least that stand to lose the most.

Missing from the Budget almost entirely was the climate crisis. It seems almost inconceivable that we are about to host COP26 – among the most important global summits ever held, our last and best chance of stopping runaway climate change – and the Chancellor has just presented a Budget that all but ignores the pressing cause that this summit is meant to address.

The Chancellor could have laid down the gauntlet to the other world leaders by announcing an ambitious spending programme to transition to a low-carbon economy, creating thousands of jobs in the process.

Instead, Sunak cut taxes on domestic flights and pledged just £7.5bn of new spending relating to the climate and nature. Analysis by Green Alliance has found a £55.4bn gap in the amount of investment needed to get the UK on track to hit our Net Zero and nature targets.

But what about the winners from this Budget? They would be the banks. A 5% cut to the corporation tax surcharge, saving banks £4bn in taxes over five years, will help ensure those huge Christmas bonuses remain untouched. The Chancellor’s determination to forge ahead with an £20 per week benefits cut for millions of people looks particularly cruel in this light.

“This week, the champagne, now cheaper, will be flowing in the City, while thousands wonder how they’ll serve tea to their kids tonight”

Meanwhile, last year the wealth of British billionaires increased by £40bn. Instead of a tax on those who can barely afford it, we should implement a wealth tax on those who most definitely can. The Wealth Tax Commission found a one-off wealth tax could raise one-quarter of a trillion pounds over five years.

This week, the champagne, now cheaper, will be flowing in the City, while thousands wonder how they’ll serve tea to their kids tonight. Foodbank use will continue to boom, my generation will be stuck paying a fortune in rent, and, for far too many, precarious work still won’t pay the bills. An age of optimism? No, this Budget changes little.

Britain’s policing was built on racism. Abolition is unavoidable

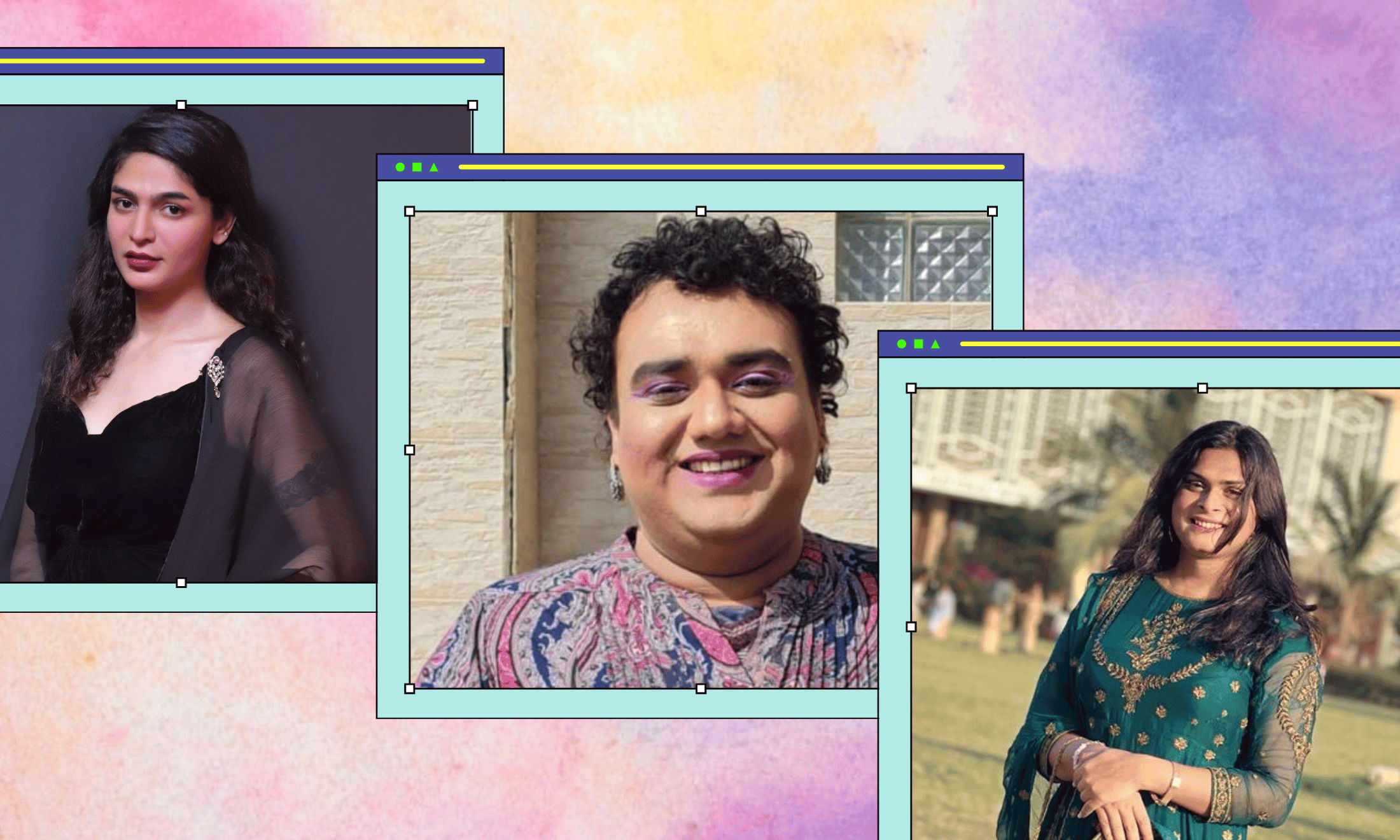

How Pakistan’s Khwaja Sira and transgender communities are fearing and fighting for their futures

Their anti-rape performance went viral globally. Now what?