How the state is forcing the most vulnerable into the hands of loan sharks

The UK's rising cost of living is affecting racialised communities the most, leaving many with no option but to rely on illegal money lending.

Shahed Ezaydi

27 Jul 2022

Aude Nasr

Content warning: this article contains mention of domestic violence and suicide.

Aliya had just escaped an abusive relationship when she found herself unable to cover the bills that month. Soon after moving with her three children to a home in north-east England, her hours were cut at work, and Aliya needed money quickly. Desperate for emergency short-term cash to see her through to the end of the month, she accepted financial help from a mum at her son’s school, thinking it was just a friend helping her out. But this ‘friend’ soon turned out to be a loan shark who used intimidation and violence against Aliya and her family when she struggled to keep up with the rapidly mounting repayments.

“There were threats on my life and on my home. I had windows put in and I’d get messages of people bullying me because she had sent them to my door as part of her campaign of terror,” she tells gal-dem.

Her initial loan of £350 had added up to nearly £2,500 over the course of a couple of months. The abuse became so sustained and constant that Aliya fled her new home with her children, leaving everything behind and ended up homeless, flitting between friends’ houses until Aliya and her family were given temporary accommodation by their local council. “I got to the point of wanting to end everything and didn’t know who to turn to.”

Aliya is just one of hundreds of thousands of people being forced to use illegal money lenders as a rising number of people face financial hardships, with those from marginalised backgrounds disproportionately feeling the effects of the cost of living crisis.

“Racialised communities are almost twice as likely to be in serious debt as white people”

Debt Justice

Many households who may have already been on tight budgets have now found themselves unable to pay their bills, with low-income families paying up to £541 a year more than higher income households for the same basic services. This effect is compounded even further when race and ethnicity is taken into account, as the wealth gap between racialised communities in the UK remains stark – Black African and Bangladeshi households, for example, have 10 times less wealth than white British people. Meanwhile, more than a third of workers from racially diverse backgrounds say their salaries won’t cover expenses, compared to 27% of those from white backgrounds, according to research by People Like Us and Censuswide.

“Household debt was already a problem before the Covid-19 pandemic for racialised communities, and that problem has only grown now in the cost of living crisis,” a Debt Justice senior policy officer tells gal-dem. “The systemic racism that is built into our economy means communities of colour are disproportionately pushed into debt. Black people have the highest debt-to-income ratios in the UK and racialised communities are almost twice as likely to be in serious debt as white people.”

A spokesperson from Money A+E, a money advice and education social enterprise where the majority of its clients are from ethnically diverse backgrounds, adds there’s been a huge increase in demand for their services in recent months. “We’ve seen a devastating impact on our clients and the communities we work with, people have been pushed beyond the knife edge just so they can cover the bare essentials.”

These issues are increasingly forcing people into the hands of illegal money lenders due to legal options becoming so limited, especially for those who may already be in debt or are unable to access public services because of their immigration status. According to the Centre for Social Justice, as many as 1.08 million people could be borrowing from a loan shark in the UK right now, a statistic that will only rise as more people are plunged into poverty. “As the cost of living crisis sets in, we can expect more vulnerable people to fall foul of exploitative loan sharks,” the CSJ said in their 2022 report, Swimming With Sharks.

Those targeted by loan sharks are already the most marginalised people who have low incomes, are unemployed, have poor health and existing debts to legal creditors. The CSJ study found 45% of victims surveyed said they borrow to cover everyday costs such as household bills or purchase other necessary items like school uniforms. “The combination of pressures on household budgets, low financial resilience and increasingly limited credit options is liable to create a perfect storm in which people are driven towards exploitation,” the report stated.

Illegal money lending is the process of conducting a consumer credit business without permission or licence from the Financial Conduct Authority. In other words, it’s usually a cash loan with huge interest rates from an individual or group that involves little to no paperwork or official documentation of the loan. Because this form of lending is against the law, those loaning out this kind of money – referred to as loan sharks – can be dangerous people that exert violence and control over their victims.

“I’m just worried all of the time, but it’s the only way to make sure my family is okay”

Sarah

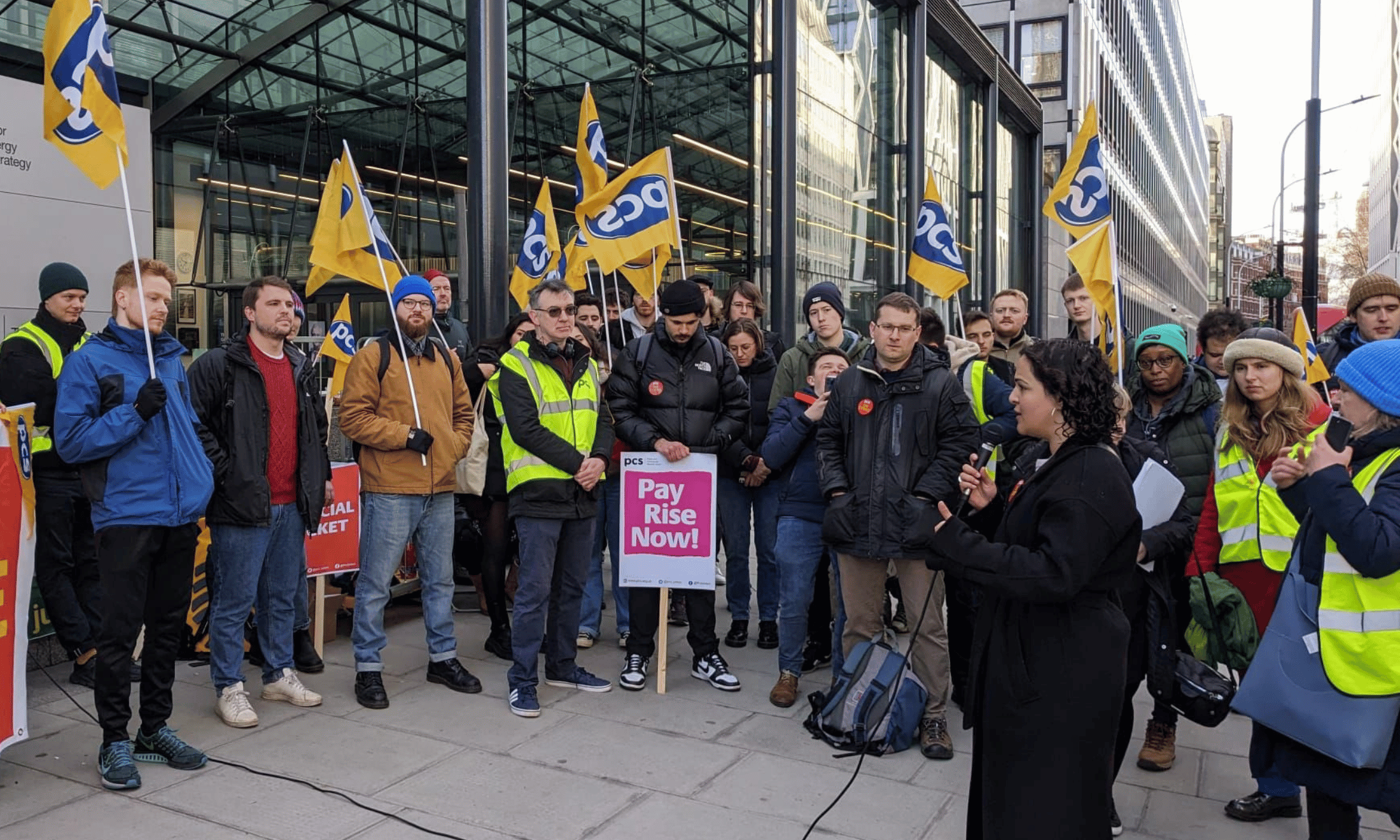

In the last six years, the Illegal Money Lending Team in England have conducted 263 operations and arrested 327 loan sharks, seizing hundreds of thousands of pounds – yet those are just the loan sharks who are reported and found.

Some lenders may have just a handful of clients, others may be part of a sprawling operation. Aliya experienced one common tactic, where the lender befriends victims before opening them up to exploitation. CSJ noted in their research that lenders have been found to approach vulnerable parents in the playground, or even encourage children to prompt their parents to borrow money.

The impacts can be devastating. The CSJ found that over a quarter of all victims surveyed had considered or attempted to take their own lives at some point, with almost 75% saying they’d done so while borrowing money from an illegal lender.

Relying on lenders every month has begun to take a heavy toll on Sarah’s* mental health. “I find it all to be really stressful and the anxiety is even affecting my physical health now,” she tells gal-dem. “I’m just worried all of the time, but it’s the only way to make sure my family is okay.”

Like Aliya, Sarah sought out an illegal money lender because she simply saw no other choice in order to provide for her family. Sarah is an asylum seeker and received no support from the government due to the ‘no recourse to public funds’ condition of her immigraiton status.

This exclusion from state welfare has pushed people with an uncertain or temporary immigration status even further to the margins, with 81% of people with no recourse to public funds behind on at least one bill, compared to 20% of the rest of the UK population.

“The cost of a 1kg tub of Lurpak butter reached £9.35 in one major supermarket – a price just under the national living wage of £9.50”

Sarah has tried to pick up extra shifts at work but has found it difficult to balance caring for her two children, something she has to do herself as she can’t afford childcare. “I’m trying to earn more money but I can’t leave the children all the time. We’ve now stopped eating lunch and just try to have two meals a day, a late breakfast and then dinner,” she explains. She is still having to borrow money this way to cover her rising bills.

This year saw a culmination of increased household costs come into effect, including a huge 54% rise in our energy bills, while the cost of a 1kg tub of Lurpak butter reached £9.35 in one major supermarket – a price just under the national living wage of £9.50 per hour. It’s unsurprising then, that households who have been pushed to the absolute brink, with little to no state support, are now turning to a very hidden form of debt to cover their bills.

“We’re very concerned about the impact that this is having on everybody, but particularly low-income families and diverse ethnic communities. It’s causing high levels of stress and anxiety on our clients and it’s these households that are really seeing the sharp edge of the cost of living crisis,” says Money A+E’s communication lead.

“It can be a really isolating experience to go through, as there’s still so much stigma surrounding talking about money, debt, and financial issues. We’ve worked with a number of people who it’s taken them six months to a year of being in debt to reach out for initial support,” she says.

Structural inequality is upheld by the state and has pushed marginalised communities into dangerous situations with no other choice. Successive Tory governments have implemented years of austerity measures that have gutted public services, and in recent years, Boris Johnson’s government cut the £20-per-week uplift to Universal Credit and is now considering cutting childcare costs by £40 per week.

Sarah and Aliya turned to loan sharks for money because they felt the state had failed them, and they aren’t the only ones. Aliya is now in a much better place where she isn’t having to turn to illegal lenders for money and is receiving support from the Illegal Money Lending Unit – a UK-wide organisation that investigates illegal money lenders and offers support to victims. Even though there is support for those using illegal money lenders, the root causes behind why people are having to turn to them lie in the hands of the state.

Sarah is still in debt, regularly borrowing money from an illegal lender. “I need money from lenders every month to keep us afloat, I just don’t see another way out,” she says.

*Names have been changed to protect anonymity

- You can report a loan shark or seek out support through the Illegal Money Lending Unit.

- Citizens Advice offers information on what loans or credit you could be eligible for, and organisations such as StepChange and Money A+E can be contacted for expert debt advice.

Our groundbreaking journalism relies on the crucial support of a community of gal-dem members. We would not be able to continue to hold truth to power in this industry without them, and you can support us from £5 per month – less than a weekly coffee.

Young Black men are being jailed over text messages

Inside the online forums where anti-Gypsy, Roma and Traveller sentiment thrives

Revealed: ‘Shocking’ number of asylum seeker infant deaths in Home Office housing